Building a Multi-Vendor Marketplace with Spree Commerce Open Source and Stripe Connect

If you’re planning to use an open source multi-vendor marketplace that aggregates products from existing Shopify and WooCommerce stores, here are some important business model considerations when using Stripe Connect with separate charges.

The Marketplace Vision

A multi-vendor marketplace model allows consumers to discover and purchase products from multiple independent stores in a single shopping experience. This model has proven successful for platforms like Etsy, Maisonette, and Not On The High Street, each serving specific niches and market segments with annual GMV reaching hundreds of millions or even billions of dollars.

For platforms aggregating Shopify and WooCommerce stores, the key is to provide a seamless experience for both shoppers and store owners while managing the complexities of multi-vendor transactions.

Spree Commerce Open Source: A Multi-Vendor Marketplace Platform

The Community Edition comes with a free, open-source multi-vendor marketplace module with the following features:

Multi-Vendor Core Features

- Vendor onboarding process with invites and approvals

- Vendor portal for store management and reporting

- Merchandising and inventory management across multiple vendors

- Vendor-specific pricing and commission rules

- Vendor performance monitoring and analytics

Customization and White-Label

- Fully customizable frontend

- White-label vendor portal

- Custom commission structures

- Flexible shipping rules

- API-first architecture

- Extensible plugin system

The Enterprise Edition of Spree Commerce provides a comprehensive suite of features designed specifically for building and scaling multi-vendor marketplaces:

Payment Processing with Stripe Connect

- Automated split payments between marketplace and vendors

- Support for multiple payment methods including cards and digital wallets

- Configurable marketplace fees and commission structures

- Automated payouts to vendors

- Comprehensive transaction reporting

- Built-in fraud prevention tools

Inventory Synchronization

- Real-time inventory updates across platforms

- Stock level monitoring and alerts

- Automated out-of-stock handling

- Multi-warehouse support

- Bulk inventory updates

- Inventory history and reporting

Order Management and Fulfillment Automations

- Centralized order management system

- Real-time order sync to vendor stores

- Automated shipment tracking updates

- Multi-vendor order splitting and routing

- Return and refund management

- Integration with major shipping carriers

Shopify and WooCommerce Integration

- Native API integration with both platforms

- Automated product catalog sync

- Real-time inventory updates

- Order flow synchronization

- Preservation of vendor workflows

- Minimal vendor technical requirements

The eCommerce Risks: Refunds, Returns, Chargebacks, Disputes, Fraud

One of the key decisions, with business model consequences, is who should take the risks, customer service burden, and potential liability associated with running a multi-vendor marketplace. These risks include:

- Refunds: Managing customer dissatisfaction and return of funds across multiple vendors

- Returns: Coordinating product returns with individual stores and their policies

- Chargebacks: Dealing with payment reversals initiated by customers through their banks

- Disputes: Resolving conflicts between customers and stores

- Fraud: Protecting against fraudulent transactions and maintaining platform integrity

Separate Charges for a Multi-Store Marketplace Features

When building a marketplace that aggregates Shopify and WooCommerce stores, you’re creating a platform where:

- Consumers can buy products from any number of stores in a single order

- Each order may contain products from multiple stores

- Your marketplace hosts many competing or complementary products from different vendors

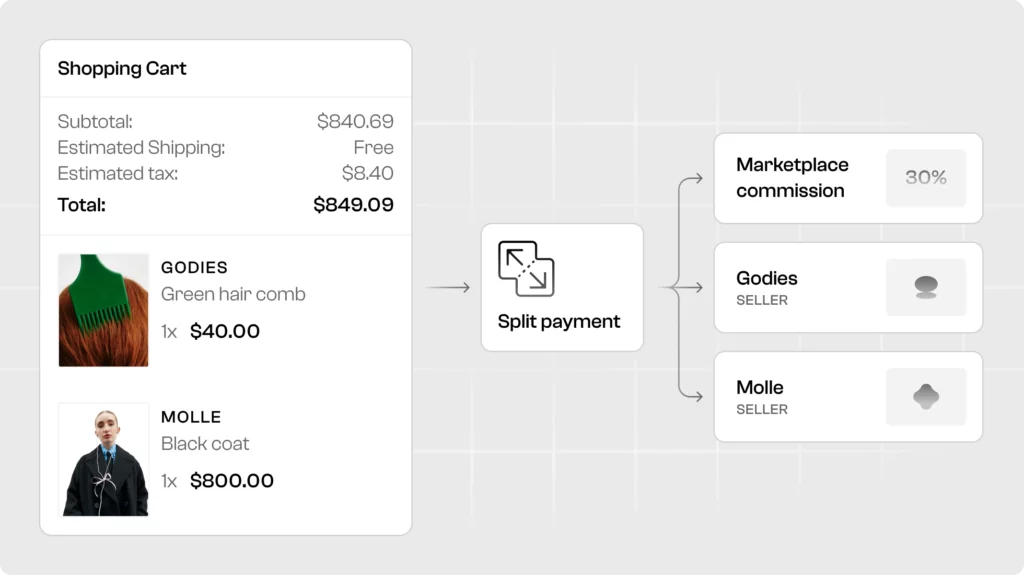

Stripe Connect with Separate Charges enables streamlined payment processing at scale:

- Capture consumer payments using cards, wallets, and installment options

- Split payments between multiple stores in a single order

- Take a marketplace fee from each transaction

- Automate store payouts

Business implications of using Separate Charges:

- The marketplace platform bears primary risk responsibility

- Individual stores maintain their standard return and refund policies

- Stores are contractually obligated to deliver quality products and fulfill orders promptly

- Platform must manage dispute resolution and customer service

Store Owner Mindset and Platform Features

Understanding store owners’ priorities is crucial for marketplace success. They want:

Seamless Integration

- Quick onboarding process with automated product sync

- Preservation of existing product data, descriptions, and images

- Maintenance of inventory sync across platforms

- Support for product variations and custom options

Order Management

- Automated order sync to their native dashboard

- Real-time inventory updates

- Preservation of their existing workflow

- Integration with their current shipping and fulfillment processes

Minimal Extra Work

- Operation entirely from their familiar Shopify or WooCommerce dashboard

- No need to learn new systems or platforms

- Automated tracking number sync and shipping updates

- Consolidated reporting and payout management

Efficient Shipping

- Continuation of existing shipping methods and carriers

- Automated shipping label generation

- Integration with current fulfillment services

- Preservation of shipping rules and rates

Stripe Connect Implementation Considerations

As the marketplace platform, you’ll be the merchant of record for all transactions. This means your marketplace’s name (descriptor) will appear on customers’ credit card statements (e.g., “AMZN” for Amazon, “ETSY” for Etsy).

This strengthens your brand recognition but also means you’re primarily responsible for handling any transaction disputes or chargebacks. While you can contractually establish obligations for your vendors to cover these costs, the initial responsibility and customer relationship management falls on your marketplace.

For a successful marketplace implementation:

- Each store must complete Stripe Connect onboarding and KYC verification

- Platform must handle the complexity of split payments and fee calculations

- Automated payout schedules need to be established

- Clear policies for handling refunds and disputes must be defined

The base Stripe fee (3%) is non-refundable, while marketplace fees can be structured according to your business model and risk management strategy.

Risk Management and Platform Operations

A successful marketplace must establish:

- Clear terms of service and vendor agreements

- Standard operating procedures for dispute resolution

- Quality control measures for store vetting and monitoring

- Customer service protocols for multi-vendor orders

- Fraud prevention systems and monitoring

- Compliance with marketplace regulations

Conclusion

Running a multi-vendor marketplace is an attractive business model allowing you to aggregate products from existing Shopify and WooCommerce stores. However, it requires significant legal, risk mitigation, and customer service effort which must be justified by the market size and business opportunity potential.

Spree Enterprise Edition, available at a cost of around 5 figures a year, includes all these features for running a multi-vendor marketplace and Stripe Connect with Separate Charges with its fully customizable and flexible code base. Reach out to discuss your specific use case.

There is also an open-source multi-vendor marketplace module included with the Community Edition which comes without vendor and payment automations but otherwise is a fully featured marketplace solution. Should you like to integrate your own payment provider and onboard vendors in the most convenient way, this open-source marketplace software could be a good fit.